COLOMBO

TEA MARKET

REPORT – SALE NO 11

18TH / 19TH MARCH 2025

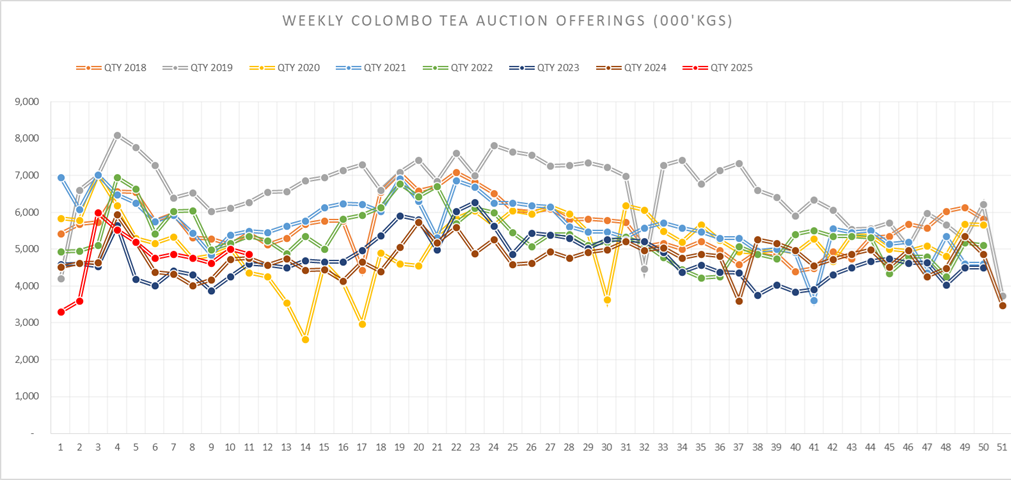

AUCTION QUANTITIES ON OFFER THIS WEEK

QUANTITIES OF TEA SOLD THROUGH APPROVED CHANNELS –

FORWARD AUCTION QUANTITIES

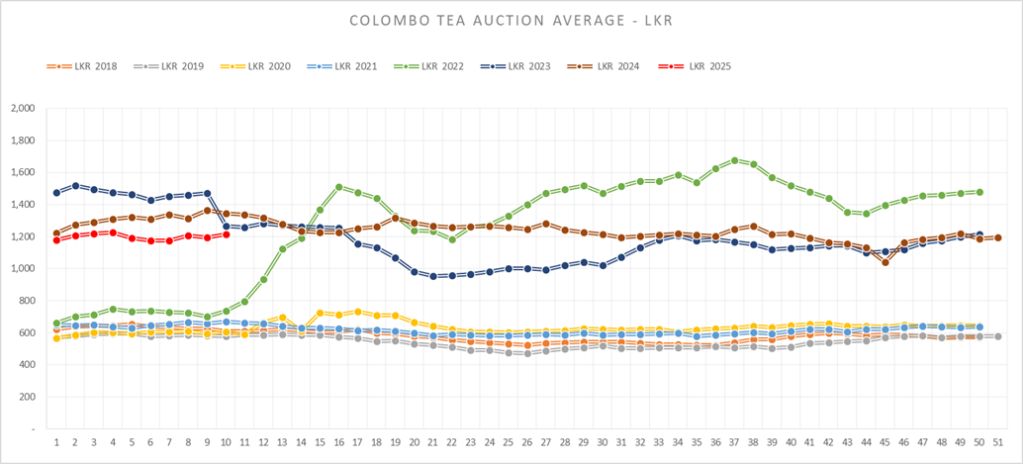

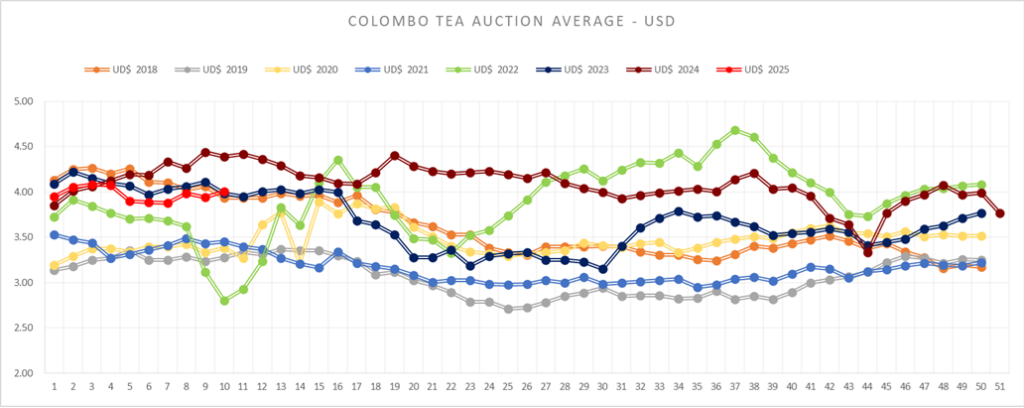

MARKET / PRICE MOVEMENT

HIGH GROWN EX-ESTATE – Fair Demand

HIGH & MEDIUM ORTHODOX – Fair Demand

LOW GROWN – Demand

SECONDARY OFF GRADES – Fair Demand.

DUSTS – Demand

UNORTHODOX TEAS (CTC) – Good Demand

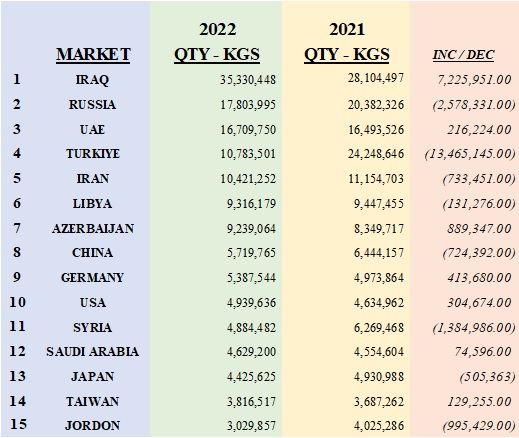

SRI LANKA – FIRST FIFTEEN TEA EXPORT MARKETS

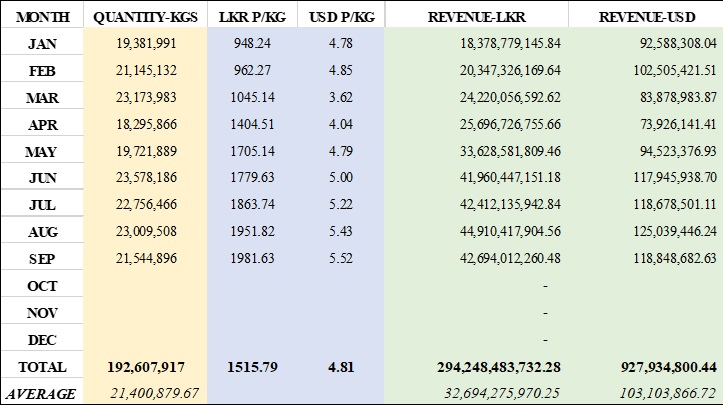

SRI LANKA TEA EXPORT GRID

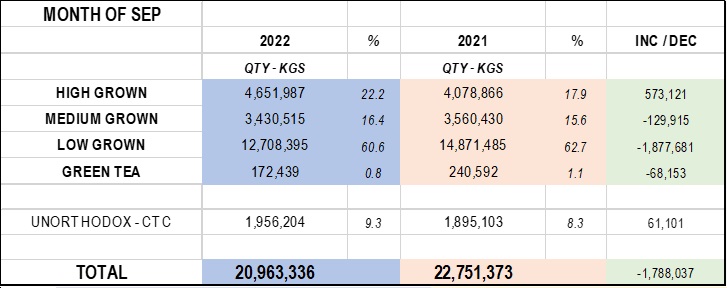

JAN – SEP 2022

TEA AUCTION AVERAGES

COLOMBO TEA AUCTION OFFERINGS – MARCH 2025

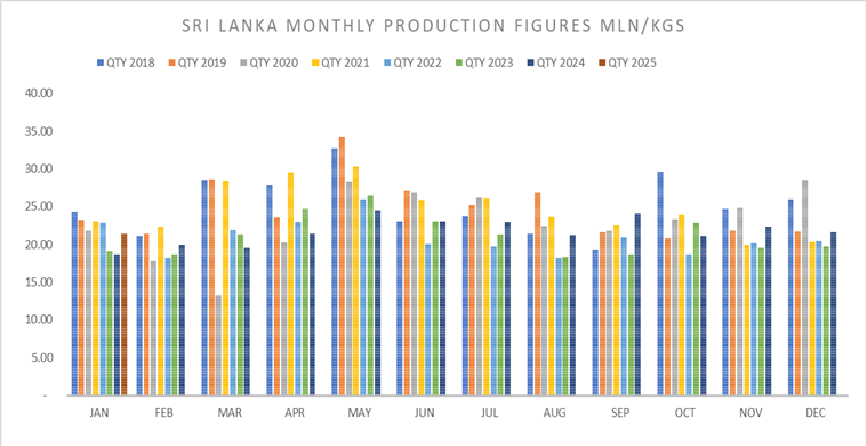

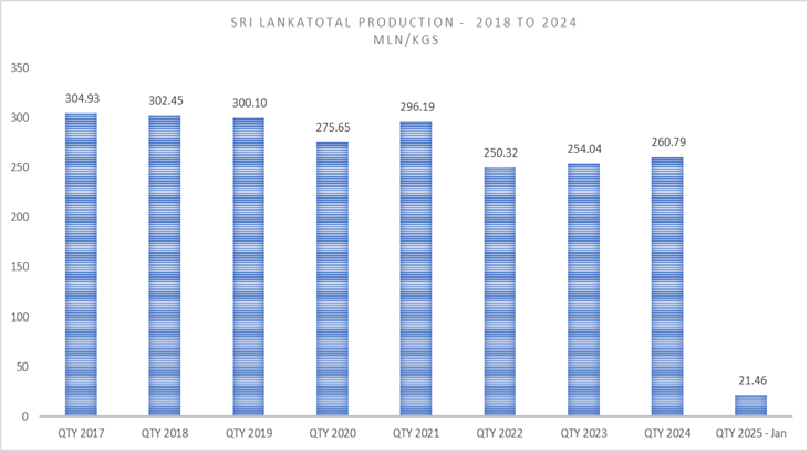

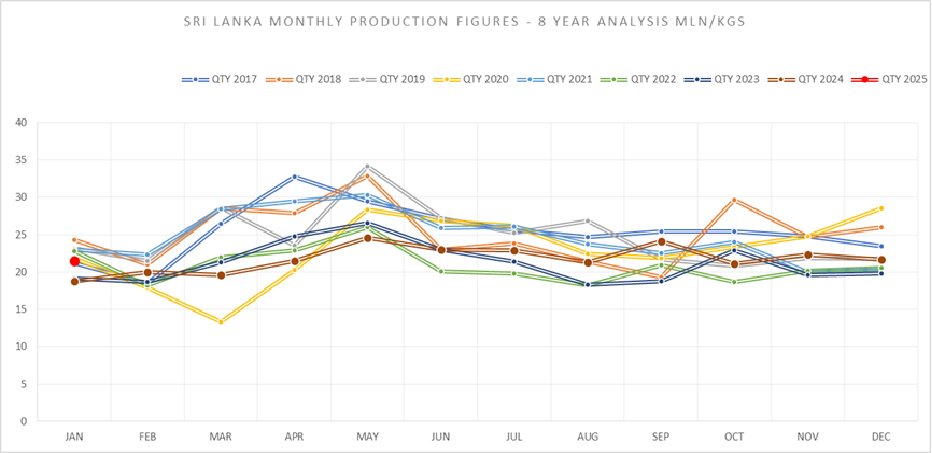

SRI LANKA TEA PRODUCTION

SRI LANKA TEA PRODUCTION – ELEVATIONAL / CATEGORY ANALYSIS

- A eight-year analysis on crop, shows that the 2025 figures for Jan, from last eight years.

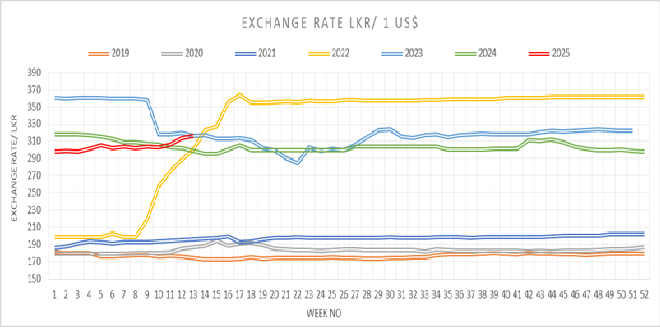

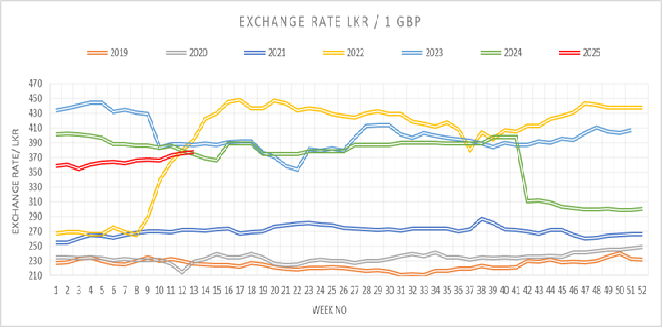

CURRENCIES – EXCHANGE RATE MOVEMENT TO-DATE

OUTLOOK – TEA

COMMENTARY

–

Address:

Tea Legacy (Pvt) Ltd

41, Manthrimulla Road

Attidiya, Sri Lanka.

Tel: +94 768 174 441

Email: connect@tea-legacy.com

Web: www.tea-legacy.com

Open Hours:

Monday:9AM-5PM

Tuesday:9AM-5PM

Wednesday:9AM-5PM

Thursday:9AM-5PM

Friday:9AM-5PM

Saturday:9.30AM-1PM

Sunday:Closed